Customers of Shopify Plus Stores

Welcome to TaxWisp, your solution for seamless tax exemption during the checkout process. This guide will help customers of Shopify Plus stores to understand how to claim tax-exempt status for your purchases and navigate the features offered by the app.

Self Sign-In and Registration

Before accessing TaxWisp and proceeding for the tax exemption, make sure you have registered as a customer to the Shopify Store.

- If you are accessing TaxWisp for the first time, you will need to sign up first with the store.

- Fill in the required information, and create your account.

- Once you are logged in through your account, you can proceed with TaxWisp for claiming the tax exemptions during checkout.

Accessing TaxWisp

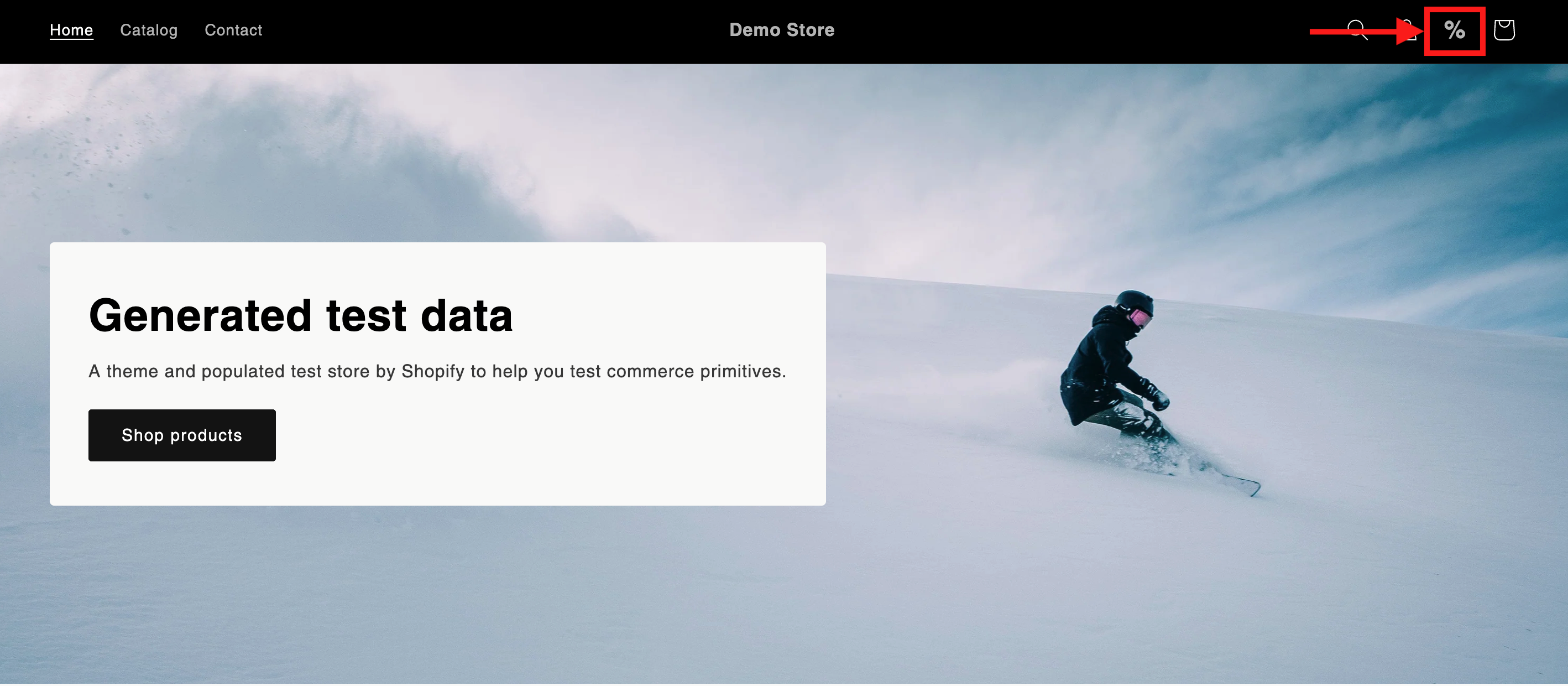

To access TaxWisp, visit the online storefront of the Shopify store.

-

You can navigate to the TaxWisp Dashboard by clicking the TaxWisp icon % in the store’s header navigation to request tax exemption. You must be registered as a customer to the store to access the TaxWisp dashboard.

-

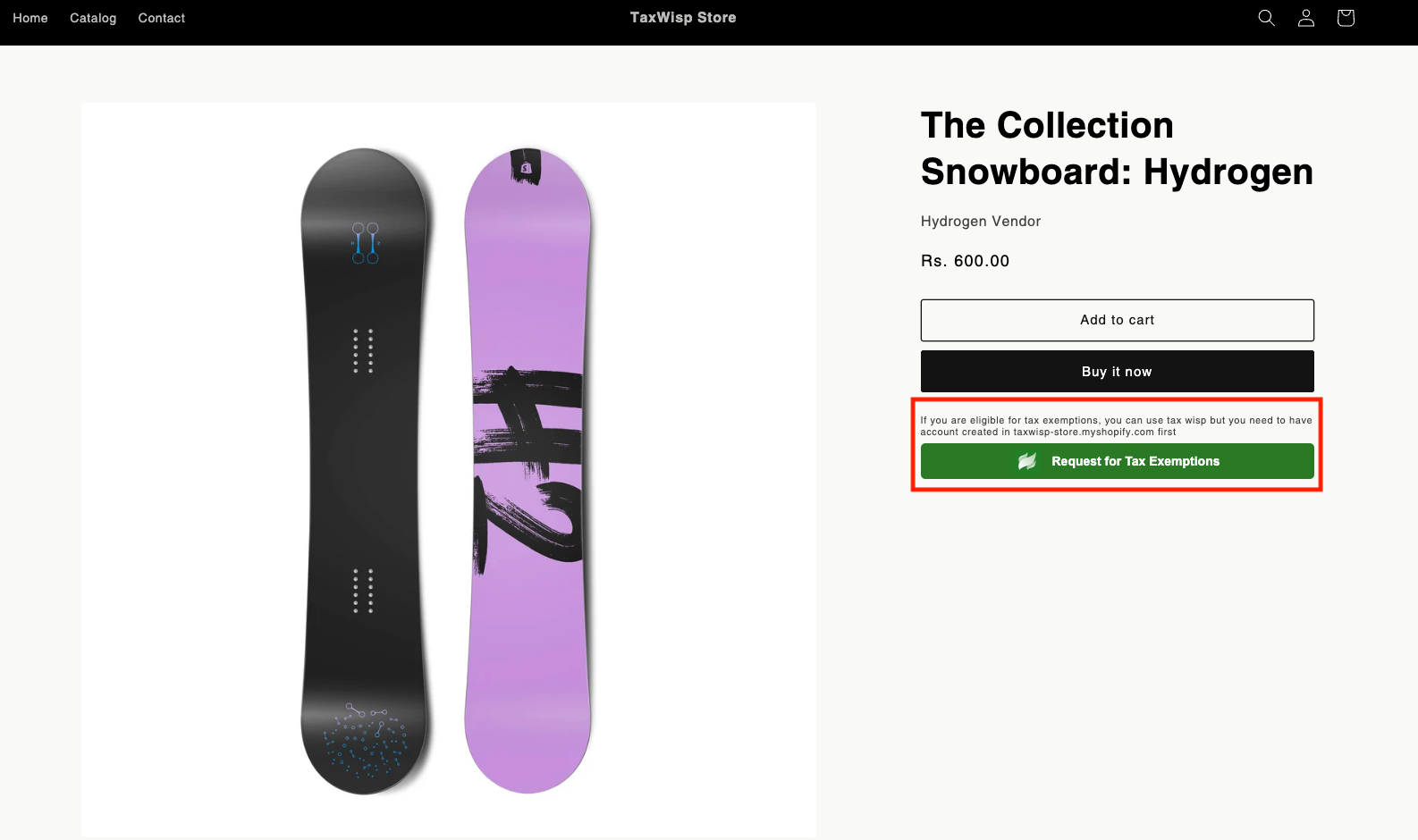

Alternatively, you can access TaxWisp from the Product Page of the Shopify store. You’ll see a Request for Tax Exemption button on the product page and request for tax exemptions directly by clicking on it.

-

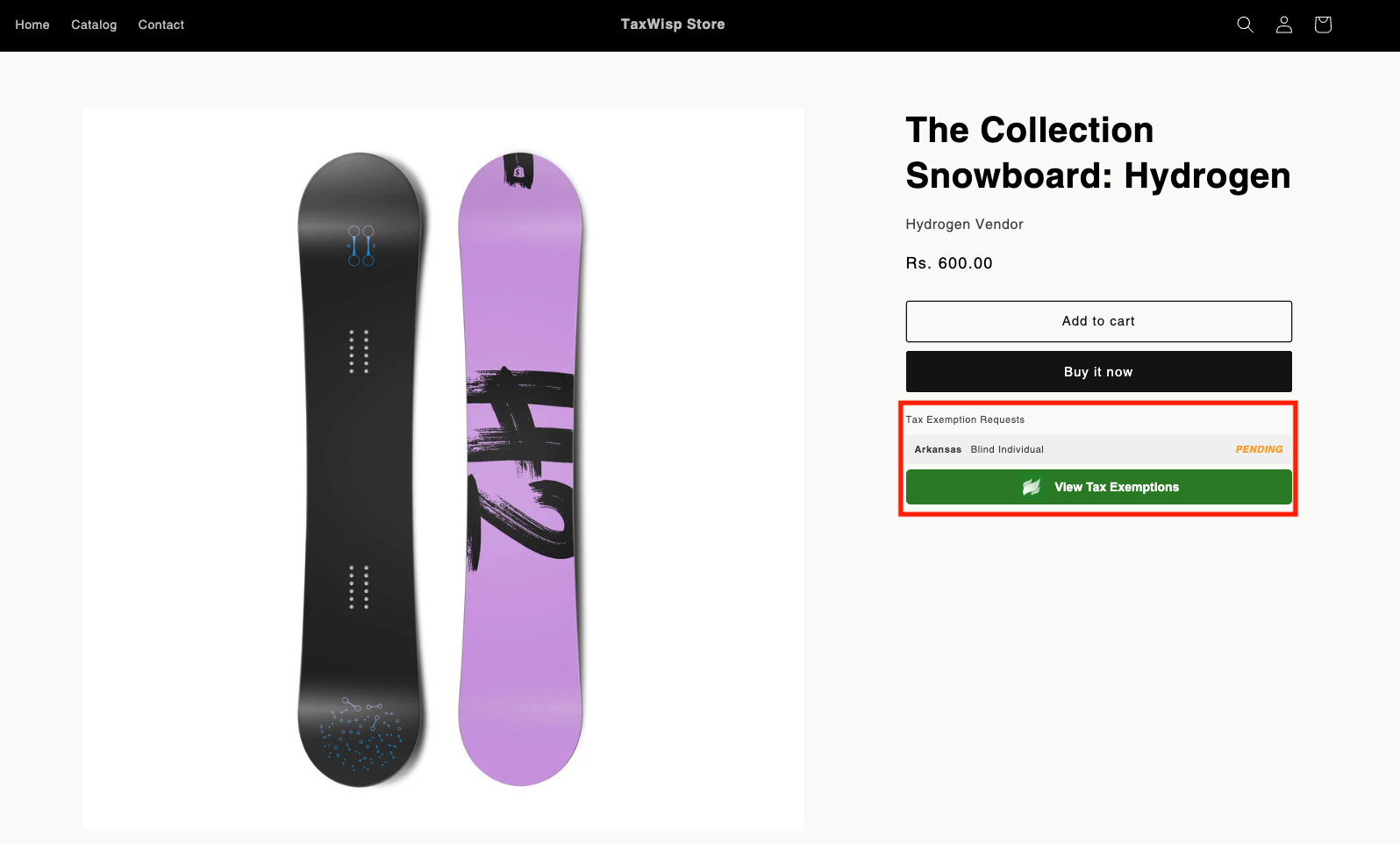

Once you have submitted the tax exemption request, your tax exemption request on pending status will be reflected on the product page itself. You can view your tax exemptions directly through TaxWisp by clicking on View Tax Exemptions button.

-

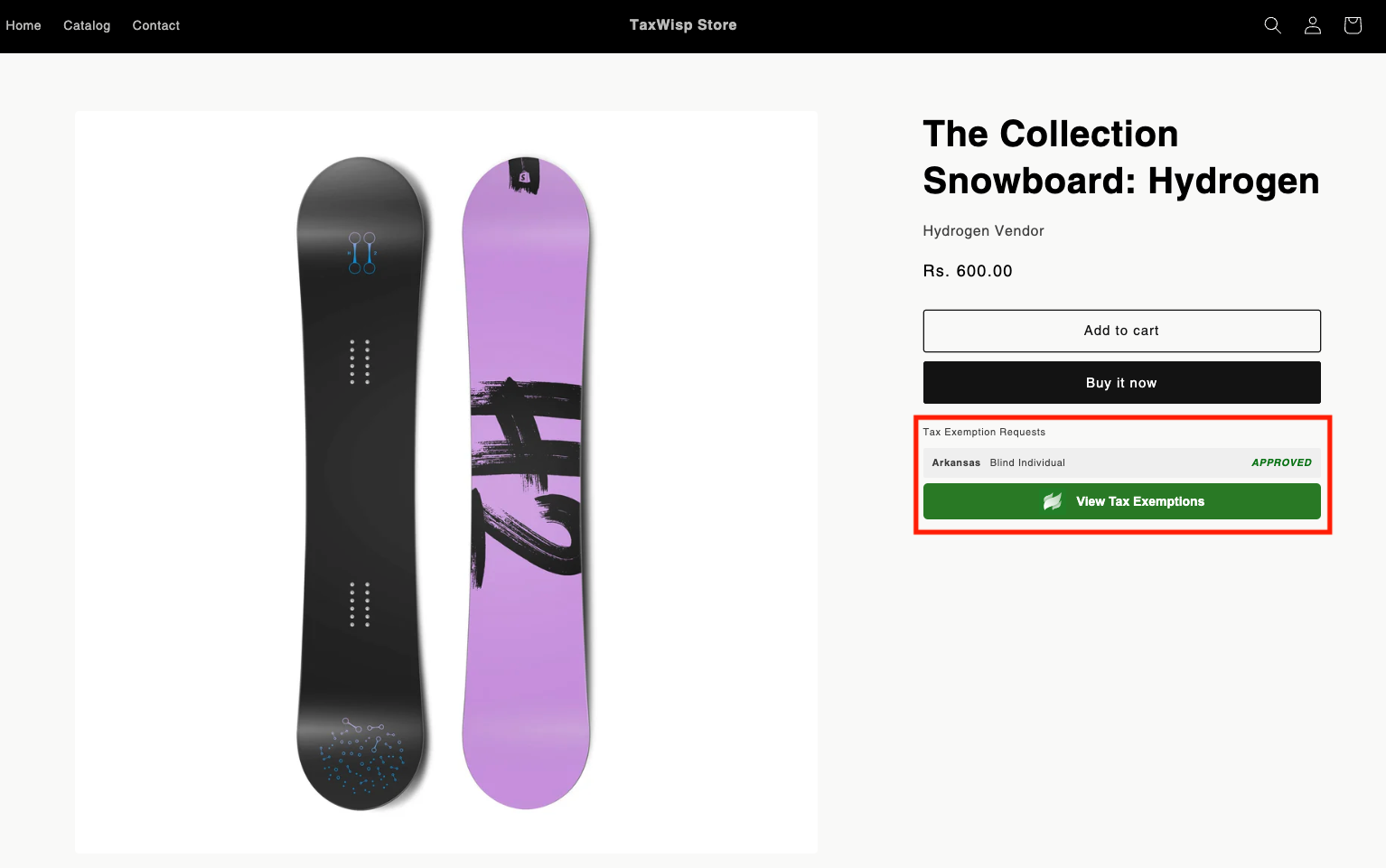

When the tax exemption request gets approved by the Store, then your tax exemption request on approved status will be reflected. You'll be now exempted from tax and your orders will be processed tax-free.

tip

tipIf the store has placed the TaxWisp extension on a different page or section instead of the Product Page, search for the Request for Tax Exemption button to proceed with your tax exemption request.

-

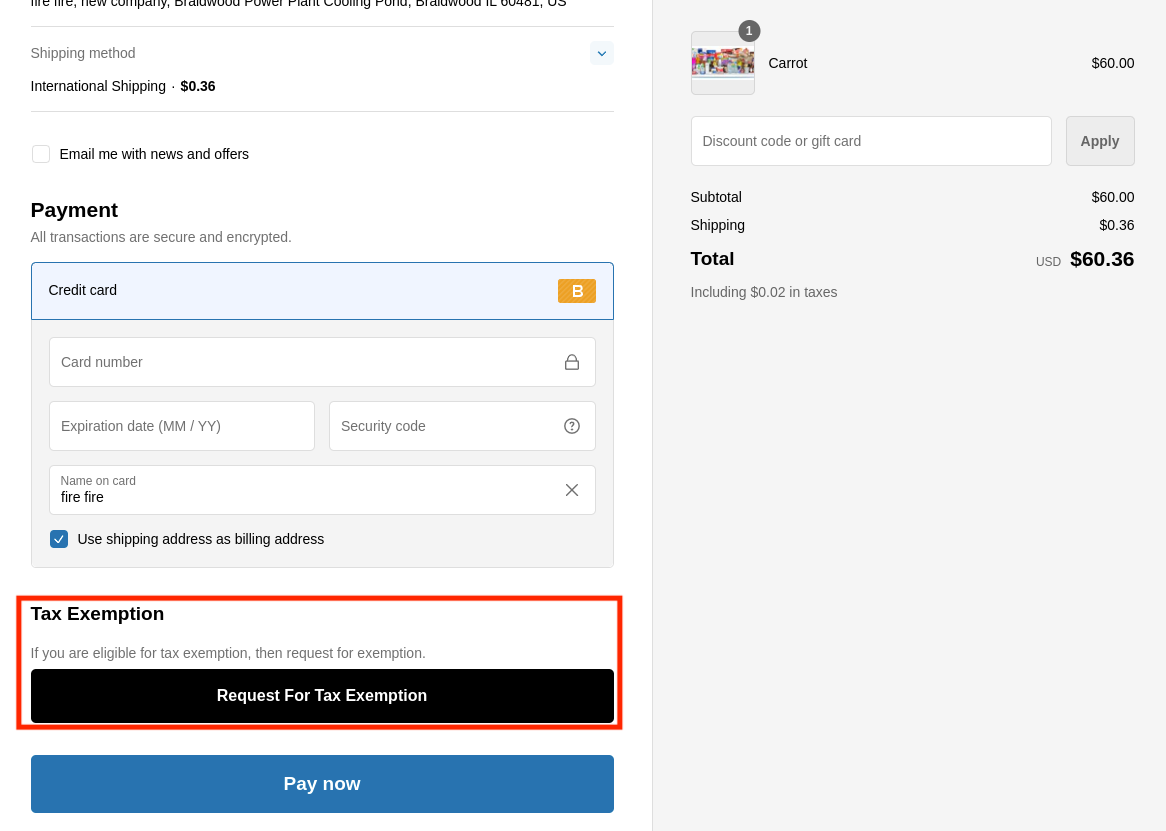

You can access TaxWisp from the checkout page of the Shopify store. You’ll see a "Request for Tax Exemption" button during checkout. In this case, you can access TaxWisp and request tax exemption directly as part of the checkout experience, which is exclusively available only for stores on Shopify Plus plan. If the store is not on a Shopify Plus plan, you won’t have the tax exemption option as part of checkout experience.

-

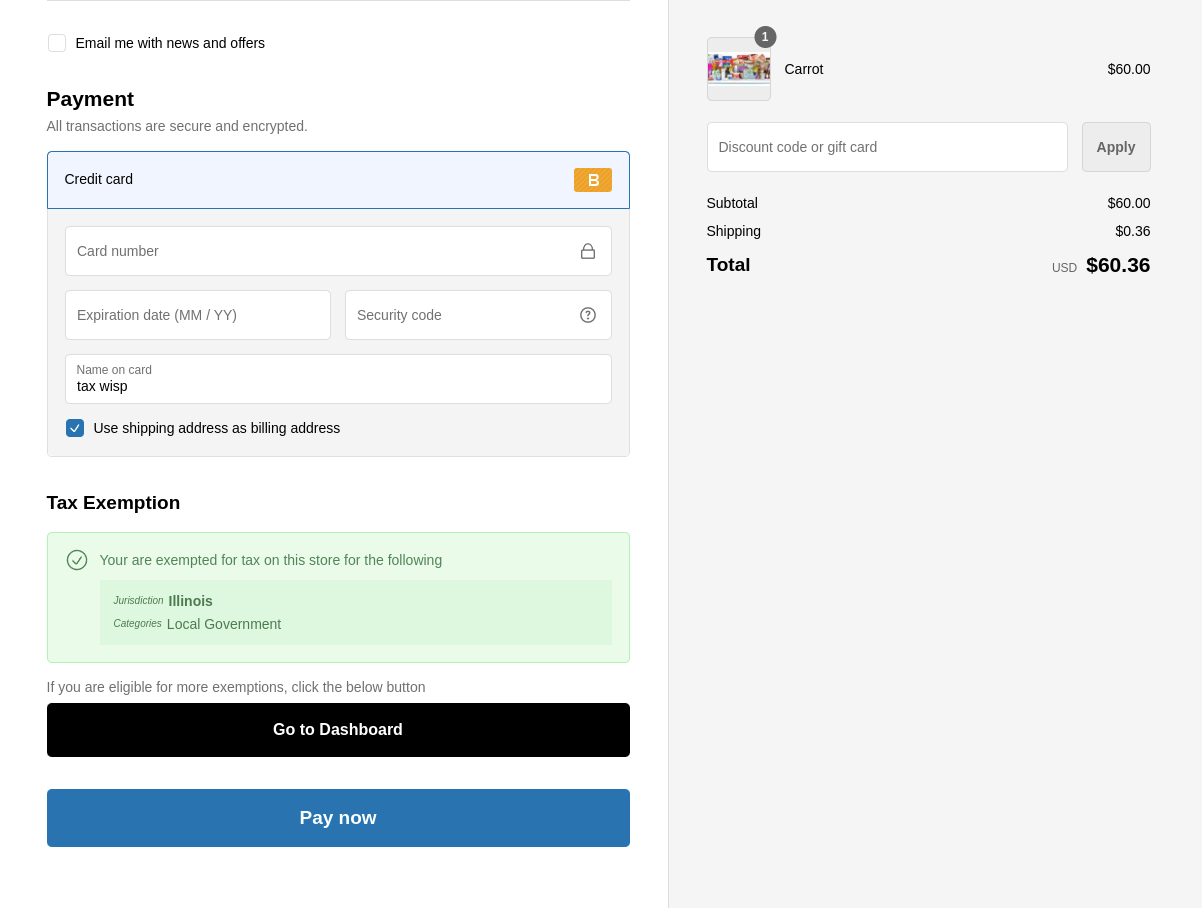

If you have been exempted already, for the future purchases, your tax exemption status will be reflected on your checkout screen itself.

-

Once you have registered, you can directly access TaxWisp using the customer dashboard for further tax exemption processes.

Claiming Tax Exemption

The tax exemption requests can be submitted either from the product pages and checkout page of the Shopify store, or directly through TaxWisp Customer Dashboard.

If you are eligible for sales tax exemption, you can claim it by following these steps:

-

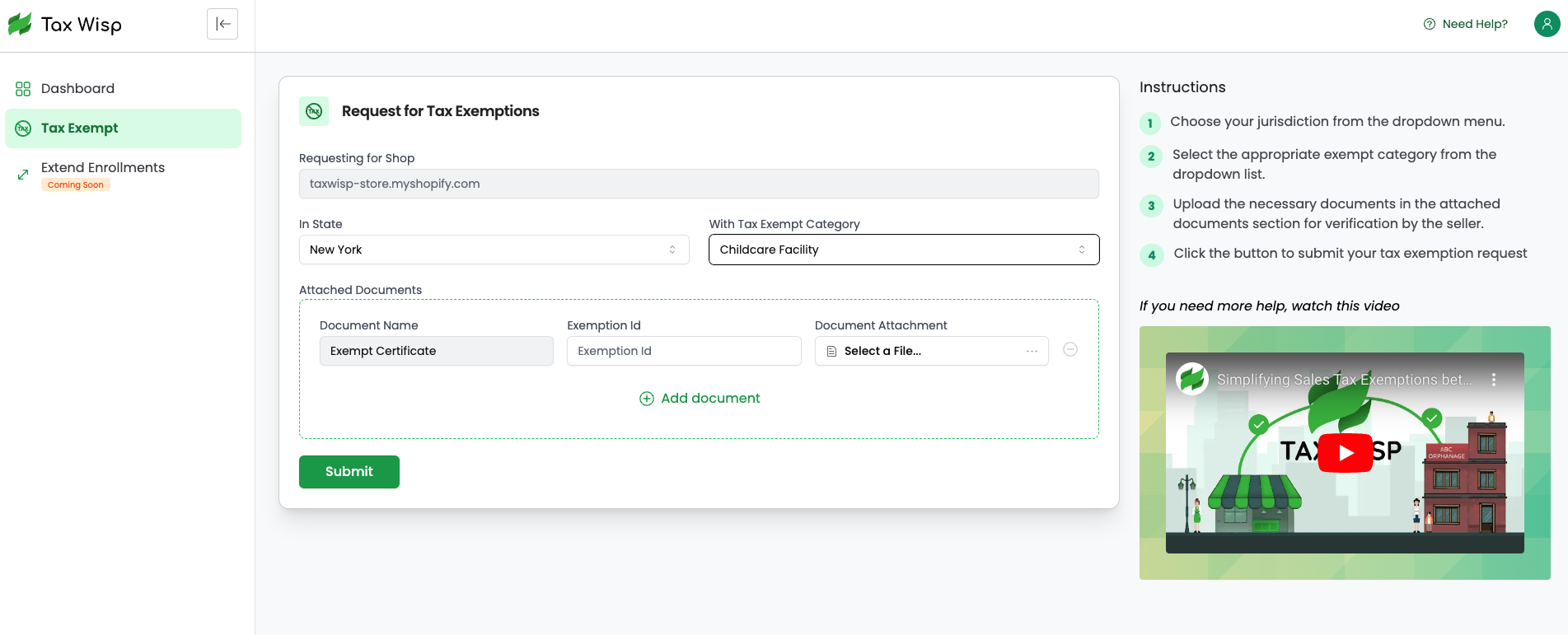

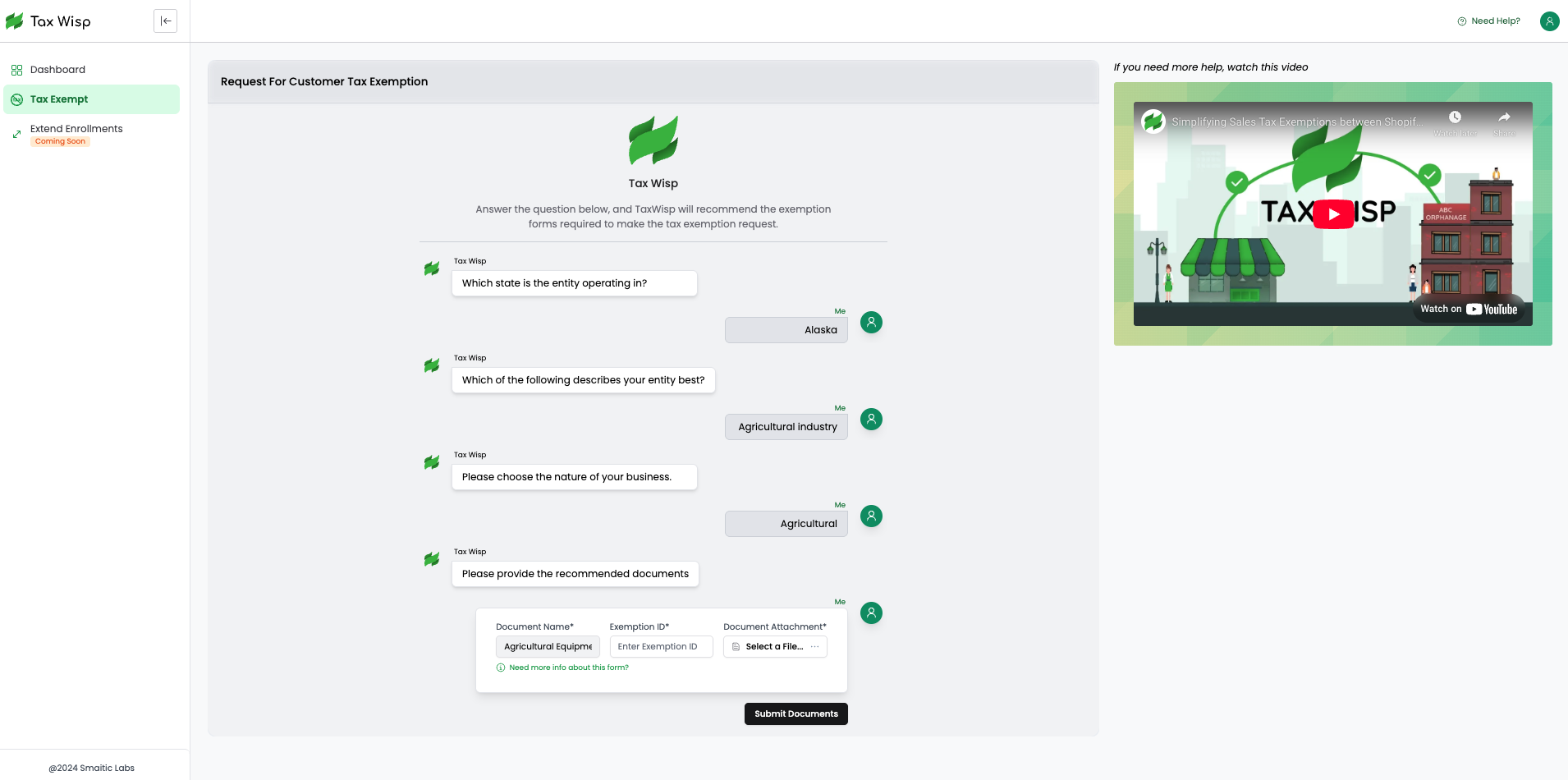

On the tax exemption request interface, provide any required information or documentation to validate your tax-exempt status. This may include uploading tax exemption certificates and providing relevant details such as Exemption ID, State, Tax Exempt Category. After providing the necessary information, you can proceed to request your sales tax exemption.

-

The process may vary depending on the store’s TaxWisp subscription.

Requesting for Tax Exemption on Stores with TaxWisp Basic Plan

If the store is on a Basic Plan of TaxWisp, you’ll be presented with a standard tax exemption request form where you’ll need to manually fill out your exemption details and upload any required documents or certificates. Make sure you enter the correct details and submit valid documents while requesting for sales tax exemption.

Requesting for Tax Exemption on Stores with TaxWisp Paid Plan

If the store is on a Paid Plan (Standard or higher) of TaxWisp, you’ll experience a smarter, guided exemption request flow. Instead of a plain form, you’ll answer a series of dynamic questions tailored to your location and purchase type. TaxWisp will automatically recommend the appropriate exemption type and filter available options based on your tax jurisdiction and the store’s product categories—making it easier and faster for you to complete your request accurately.

-

Once submitted, the store will review and process your exemption claim. You’ll be notified via email when your request has been approved or if additional information is needed.

-

If the store has enabled auto-approval, your request will be approved instantly upon submission, allowing you to proceed to a tax-free checkout immediately without waiting for manual verification.

Uploading Tax Exemption Documents

If you need to upload tax exemption documents, such as certificates or declarations, follow these steps:

- Access the Tax Exemption Request form.

- Look for the document upload section on tax exemption request form and follow the on-screen prompts to attach your files.

- Supported file formats include .pdf, .jpg, .jpeg, and .png, with a maximum file size of 25 MB. Please ensure your documents meet these requirements before uploading.

- After uploading, simply submit your tax exemption request for review and processing.

Your documents will be securely stored and reviewed as part of your exemption claim.

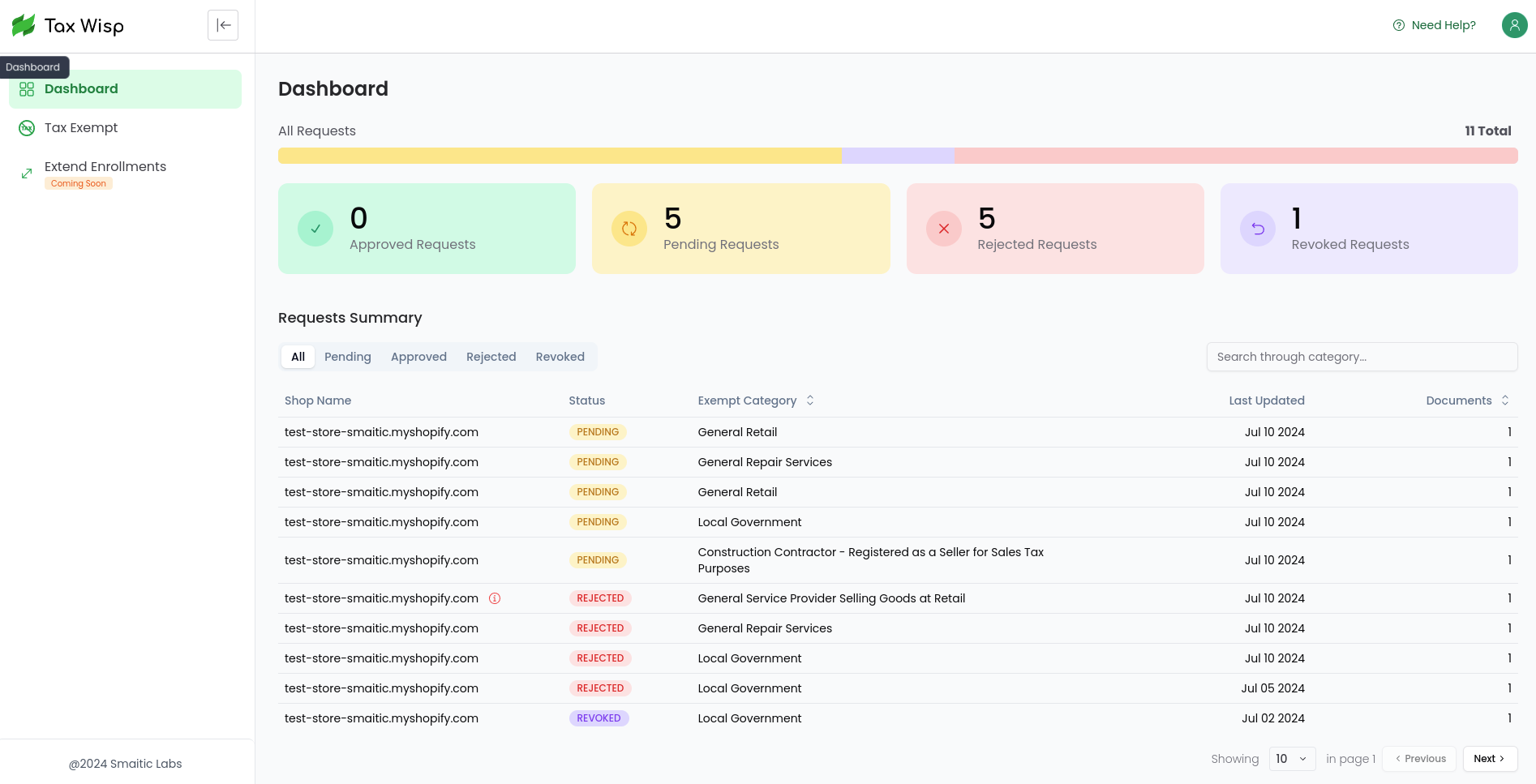

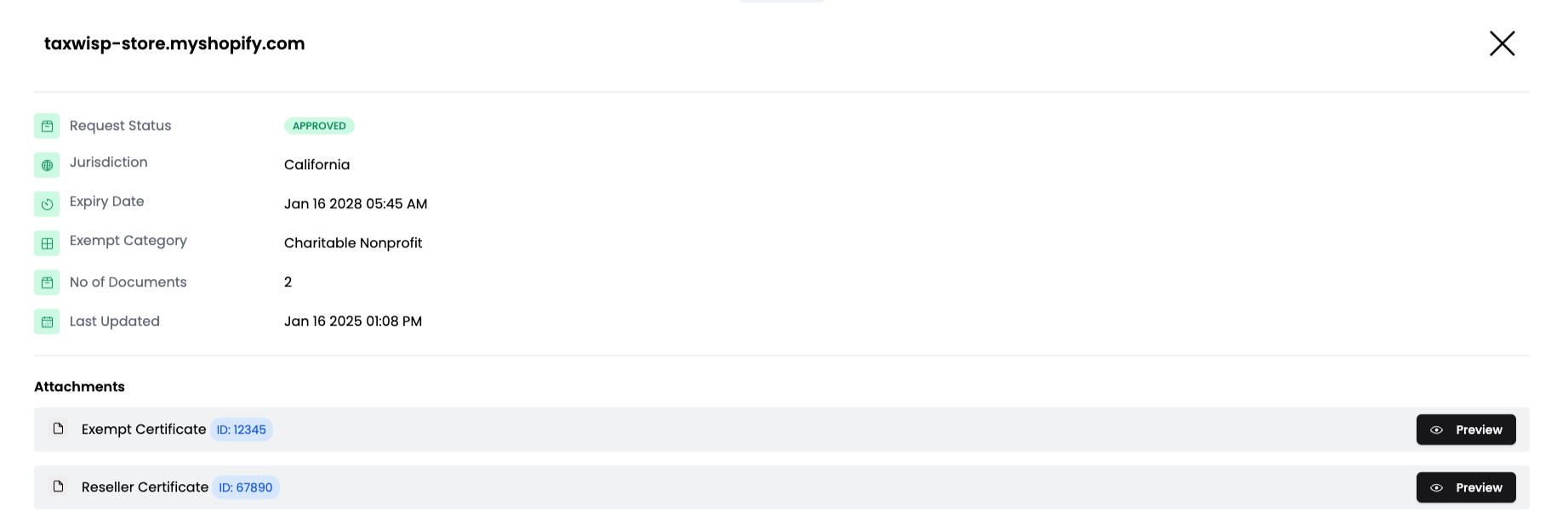

Managing Tax Exemption Status

If you have already claimed tax exemption or want to check the status of your exemption, follow these steps:

-

Access the Tax Wisp interface during the checkout process or directly navigate to TaxWisp Dashboard.

-

Look for options to view or manage your tax exemption status.

-

Review the status of your tax exemption claim. This may include information about approval, rejection, revocation or pending review.

Automated Notifications

You will receive email notifications for important updates regarding your tax exemption requests, including successful request submission, approvals, rejections, and revocation.

If you encounter any issues or have questions about using TaxWisp, don't hesitate to reach out to our support team directly from your TaxWisp dashboard or via email at support@taxwisp.ai.